The sneakers market in Chile has experienced significant growth in recent times, becoming one of the most demanded products by consumers. This phenomenon not only reflects public preferences, but also has a notable impact on the country’s economy. Through the information provided by Datasur.com, the leading portal for import and export information, we will analyze this product.

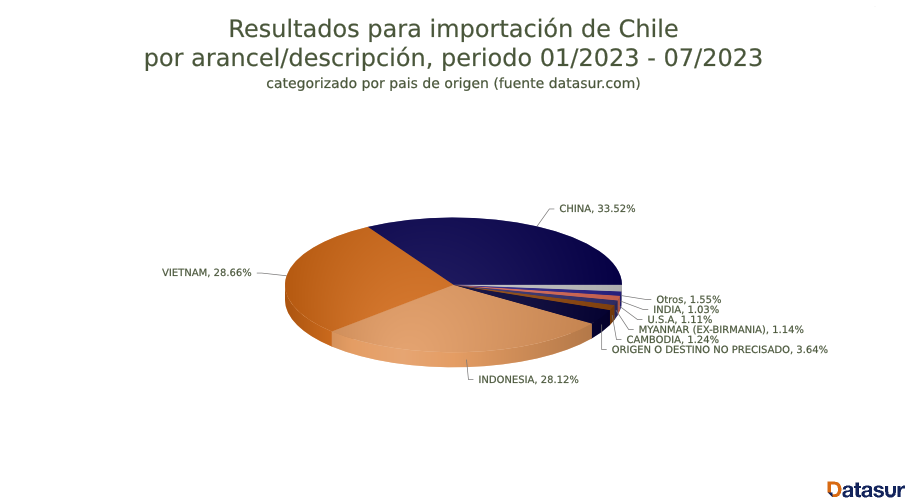

Analysis of Imports: During 2022, the main sports footwear supplying countries were Vietnam, accounting for 35.57%, followed by China with 32.33%, and in third place, Indonesia with 22.06%. However, in 2023, China rose to first place as the main exporter of this product in the Chilean market, reaching 33.52%, followed by Vietnam with 28.66% and Indonesia with 28.12%. During this period, a total of US$40,974,465.07 in imports was generated.

Business Leadership: In 2022, Adidas dominated the market with an impressive 40.16% market share, followed by Skechers with 23.37% and Puma with 16.57%. In 2023, these companies maintained their leading positions. Adidas experienced a notable increase of 43.46%, while Skechers increased its share by 24.71%. On the other hand, Puma recorded a 7.26% decrease.

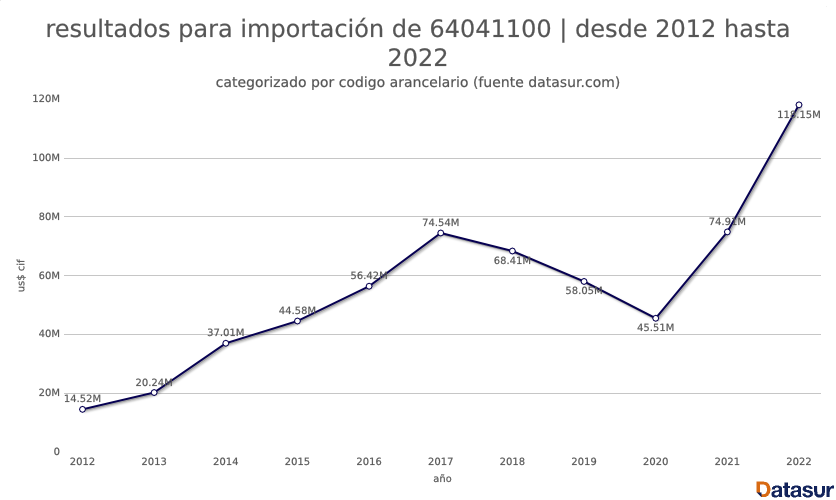

Historical Growth and Future Prospects: In the period from 2012 to 2022, imports of sneakers into Chile experienced steady growth. However, a sharp decline was observed between 2017 and 2020, reaching a low of US$45.51 million. However, the following year witnessed a notable increase, reaching US$118.15 million in 2022.

The boom in imports of sneakers in Chile is evidence of a clear consumer preference for this type of footwear. China has emerged as the main exporter, displacing Vietnam and Indonesia in the Chilean market. Companies such as Adidas and Skechers have consolidated their position as leaders in the sneaker trade, while Puma has experienced a slight decline. This sustained growth in the market promises exciting opportunities for Chile’s athletic footwear industry in the years to come.